Every Man, Woman and Child in Guyana Must Become Oil-Minded – Column 160 – 10 June 2025

Introduction

Today’s column addresses the audited financial statements of CNOOC Petroleum Guyana Limited, the third-ranking partner with a 25% interest in the Stabroek Block operating under the 2016 Petroleum Agreement. Like Exxon and Hess, CNOOC is also a branch of an external company, in this case, incorporated under the Companies Act of Barbados. Unlike Exxon and Hess, CNOOC maintains a very low profile in Guyana, leaving the heavy PR lifting to Exxon, the designated Operator under the Agreement. Its ultimate parent company is the China Offshore Oil Corporation, established in the People’s Republic of China (PRC).

But CNOOC’s annual report is not another corporate success story wrapped in glossy annual reports and feel-good community photos. This is cold, hard evidence of a foreign state-owned enterprise that systematically extracts wealth from non-renewal Guyanese resources while operating under the same controversial 2016 Petroleum Agreement that continues to benefit foreign businesses over the national interest.

Like its co-venturers, CNOOC shares in the 2024 bonanza, its income statement revealing profits that would make any multinational corporation green with envy, sweetened through a tax arrangement under which its taxes are paid by the Government of Guyana.

Financial Statements

The rest of this column examines the financial statements of the company’s participating interest in the Stabroek Block. All information sourced from the Branch’s financial statements.

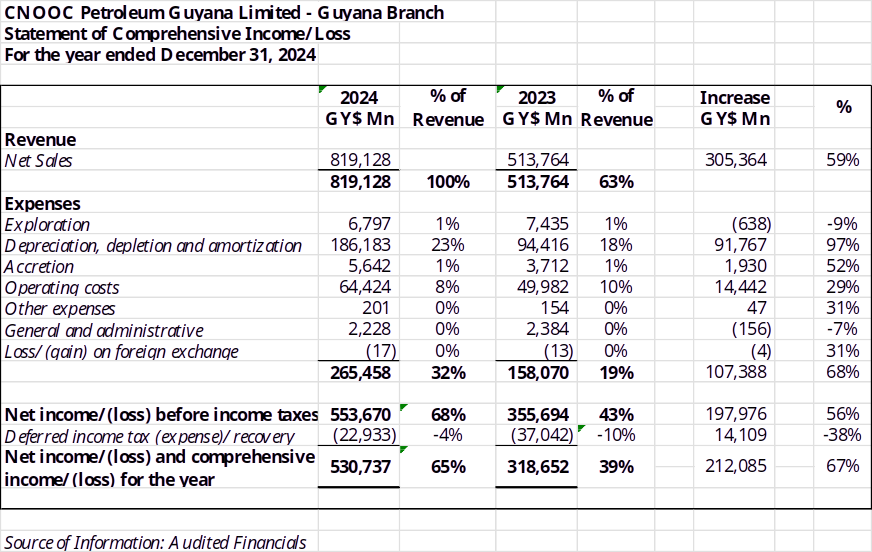

Revenue

The company’s revenue for 2024 reached G$819.1 million – a 59.4% increase over 2023. That figure includes $22.9 Mn which the company describes as “Deferred income tax expense”, presumably the amount which the Government will pay on its behalf under Article 15.4 of the Agreement. The notes to the financial statements disclose that all the oil from its share of the operations is sold to China Offshore Oil (Singapore) International Pte Ltd, a member of its group.

While total expenses for 2024 amounted to G$265.5 million, up 68% from 2023, the largest portion was not actual cash expenditure but a book transaction following accounting convention. The largest single expense is Depreciation, depletion, and amortization of G$186.2 million, representing 70.1% of total expenses – in other words, more than twice as much all other expenses combined. Operating costs was G$64.4 million, or 7.9% of revenue, revealing the Stabroek operation’s efficiency: once wells are drilled and production units installed, the cost of extracting each additional barrel is minimal.

After all expenses and the Deferred Tax Expense, the company recorded net income of G$530.7 million – a 66.5% increase from 2023. Expressed another way, the net profit margin is a massive 64.8%.

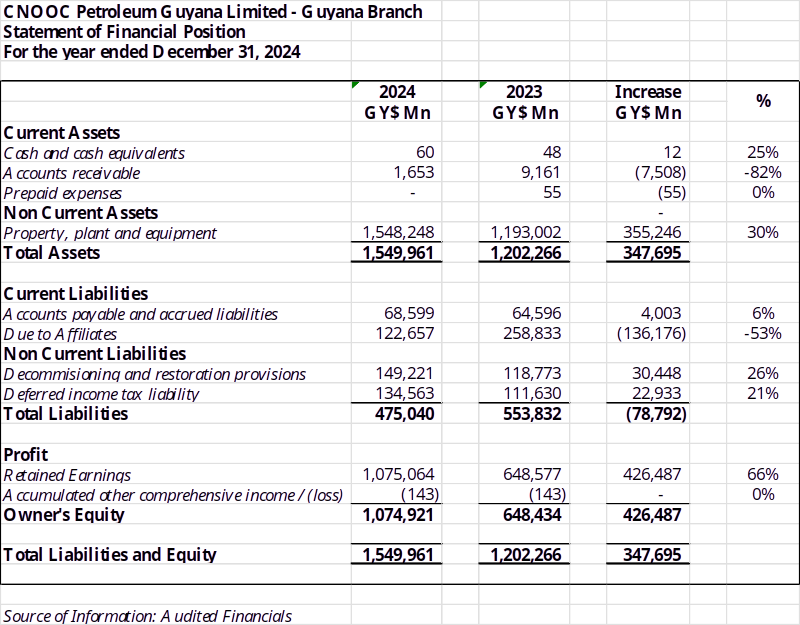

The Balance Sheet

Total assets increased during the year by 28.9% to G$1.55 billion, or 28.9%. Of this, property, plant and equipment accounts for G$1.548 billion, or 99.9% of total assets. The company’s balance sheet shows that it held just G$60 million in cash, to meet any eventuality which may arise. The balance sheet indicates that the amount due to Affiliates reducing by $136 Mn, of which the bulk was “Financing” of $107 Mn, and the remainder was “Investing”. These items need explanation since the oil companies have repeatedly stated that no interest is charged on the operations.

The liability side shows how the assets are financed – by credits, equity and retained earnings. Let us look at these. Credits have decreased from $323 Mn. to $191 Mn, or roughly 40%. Then there are the tax liability and Deferred income tax liability which makes up 18.3% of the total assets. The balance of $1,074.9 Mn, or 70% is financed by retained profits, and that is after the payment of $104.3 Mn dividends in 2024.

The shareholder’s equity is entirely made up of retained earnings of G$1,075 Mn. having grown by GYD $426.5 million in profit after dividend in 2024. This represents profits retained in the business to finance capital injection.

Conclusion

CNOOC may not have the flair of Exxon or the drama of HESS but in its own quiet and discreet way its performance matches its American counterparts in another bumper year with its hosts Guyana – or rather its leaders – mesmerised into paralysis and content to do nothing.