Every Man, Woman and Child in Guyana Must Become Oil-Minded – Column 161

Last year, my summary column discussing the 2023 audited financial reports of Stabroek Block contractors had the caption “Oil companies have earned five times more from oil than Guyana. Modest investment, gargantuan returns.” If anything has changed, the money deluge has continued to flow upward and faster in the direction of those contractors. But before we look at those incredible numbers, maybe a word about Vice President Jagdeo’s exchange with a reporter of relevance to today’s column might be revealing.

The Vice President’s shutting down the question with the words “So entirely clear” suggests that he was confused by his own garbled logic for all the world to see. For Guyanese, it was embarrassing to see the Vice President with responsibility for the dominant petroleum sector display such a poor knowledge and understanding of the Petroleum Agreement which has been around in its present form for nine years, and in its earlier form for twenty-six years. What makes it regrettable is that his response – because of its egregiously flawed answer, might unfortunately be seen and used by the oil companies as a validation of the accounting methodology, content and form when it really is just the opposite. For readers’ benefit let us recap the correct formula for the allocation of profits between the Government as a one-half party and the oil companies as a collective, as the other.

Profit is arrived at taking after a) the payment of a royalty of 2% of all petroleum produced and sold, net of deduction of quantity used for fuel and transportation; and b) deduction of recoverable cost up to a maximum of 75% of total revenue. By an amendment to the Agreement, the government and the oil companies agreed that “royalties” are not a recoverable expense charged to the operations so that much is set aside for the government. The balance is shared between the Government and the Contractor for each

Field in the following proportions: Contractor fifty percent (50%) and Minister fifty percent (50%).”

Applying the formula (100% – [2% + 75%]) ÷ 2 = 11.5% – the government receives a minimum of 13.5% (2% royalty plus 50% of profit) and the oil companies get 11.5%. Jagdeo’s 14.5 % and 10.5% are wrong. He also advances the novel proposition that there is a 75% allocation for the payback of capital invested. That too is incorrect. It is a cap on recoverable expenses for any year, whether for capital or operating expenses. And then he throws in the dead herring about Guyana’s share of profit oil without acknowledging that the government pays the taxes of the oil companies for which they are issued a Certificate of Taxes paid by someone or the other.

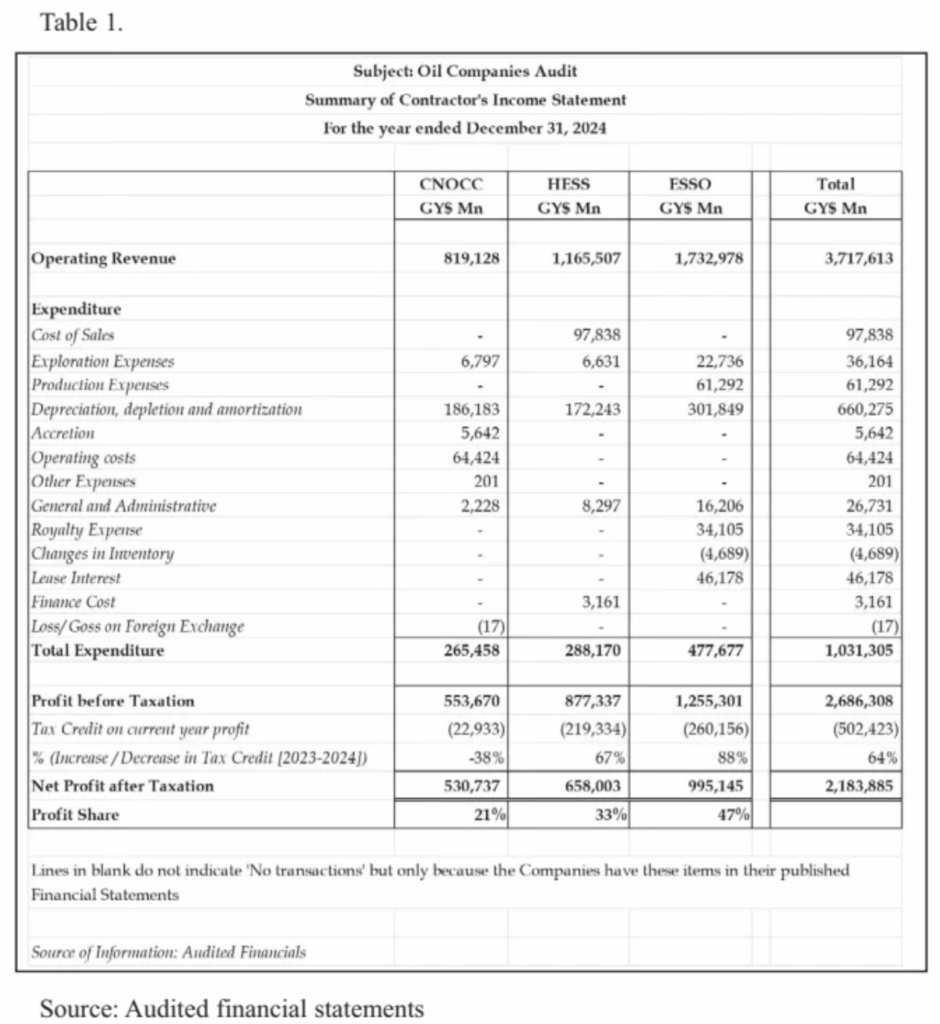

Back to the numbers

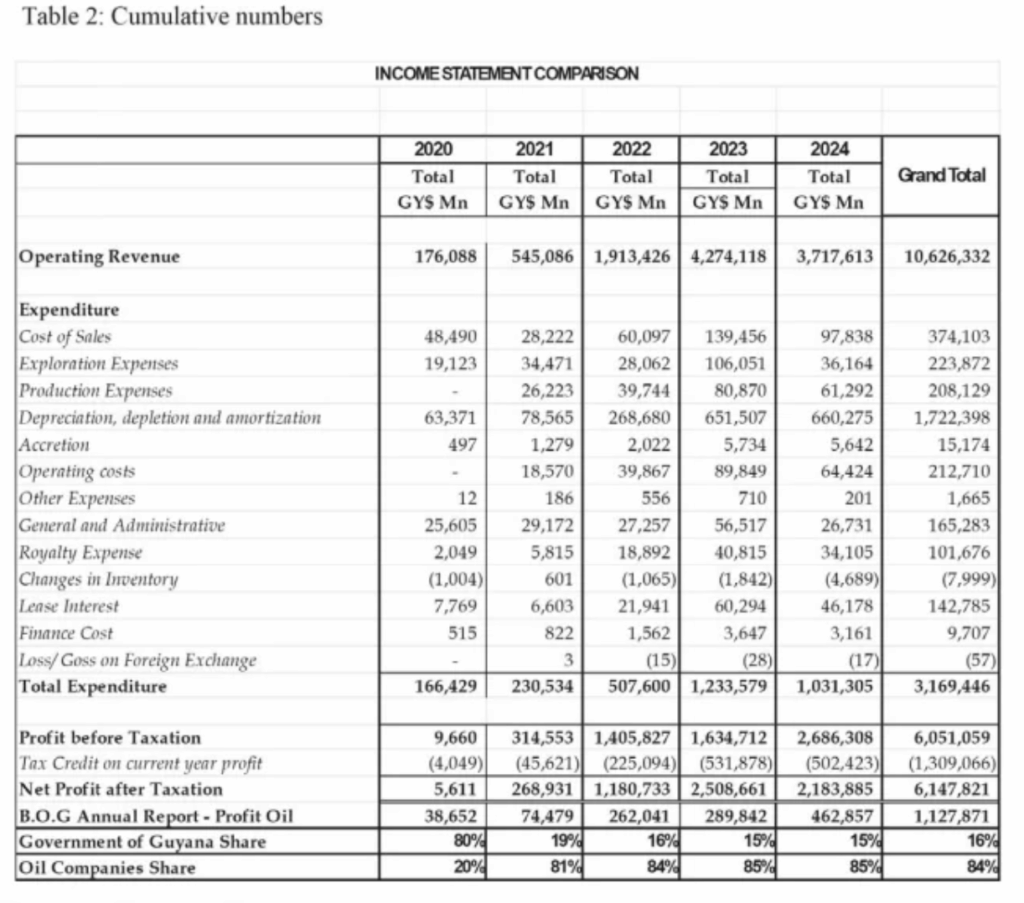

The Table is constructed from the audited financial statements of the three companies for 2024. The total profit before the mythical tax for the three companies amounted to G$2,686,308 Mn of which Exxon’s share is 47% (2023 – 46%), Hess at G$526,236 Mn. or 33% (2023 – 32%) and CNOOC of 21% (2023 – 22%). These numbers are consistent with 2023. Readers can turn to Columns 157 – 159 for a review and commentary on the 2024 financial statements of each of the three oil companies, including both their income statement and balance sheet.

Having commented in the past years about the lack of comparability of the financial statements, I am amazed that the auditors appointed by the Government at a considerable cost, never seem to have recognised this self-evident fact. Because of what is stated in the introduction, this should surprise no one.

Before any discussion on these 2024 results, I share with readers the profits earned by the oil companies from 2020 – 2024, compared with the returns to the Government over the same period.

In Column 162 to be published next Friday, we will have a general discussion on these Tables.

Chris Ram