- The contract was signed with shell companies registered in the Caribbean. If there was major oil spill, similar to what happened in the Gulf of Mexico, it would bankrupt Guyana. That spill cost BP about US$62 billion, see reference [1]. This is not conjecture as it was reported in the media that in the Kanuku Oil block we barely avoided a BP type oil spill, see reference [2]. We need to have the parents of the oil companies take on the insurance liability for an oil spill.

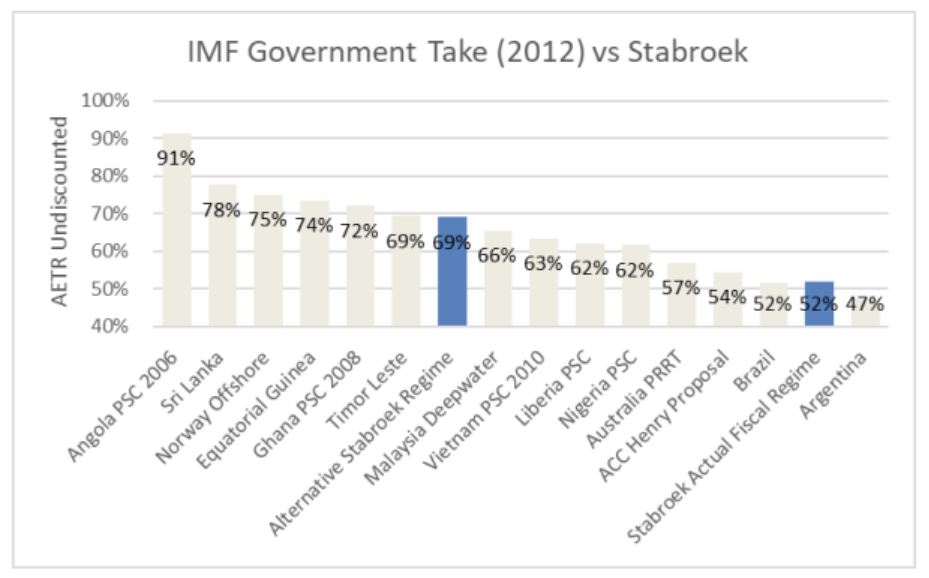

- The highly respected non-profit organization, Global Witness, which stands by it financial calculations, see reference [3], showed Guyana loses US$55 billion on 8 billion barrels when oil is at US$65/barrel. Since the Global Witness report was published in early 2020 the number of barrels of oil has been projected at 13 billion barrels. As of September 15th, 2021 the price of Brent Crude hovers around US$75/barrel. Using a similar calculation to Global Witness, and factoring this updated information Guyana loses US$109 billion dollars. To put that in perspective it is about US$140,000 for each of the 780,000 citizens in Guyana. The average income in Guyana is US$4,000/year and 30% of the population lives on US$2/day. The Global Witness report calculations is based on Guyana being in the middle of the pack of 69 oil regimes in terms of government share. We demand to be treated fairly.

- Guyana is paying taxes on behalf of the oil companies. Our citizens paid taxes to help build the roads and airports that the oil companies use to conduct their business. Our government should not be writing tax receipts for taxes NOT paid. These tax receipts can potentially be used to obtain a tax refund from the IRS. We demand the oil companies pay 25% taxes as per our laws.

- In the 1999 Stabroek contract, a key law was broken with the award of the 600 blocks when the maximum award for any single license should be 60 blocks. This is stated in the 1986 Petroleum Act, regulation 13(2). That Act makes reference to a graticular block, a unit of area of the seabed. The Act states the maximum allowed for a single license is 60 blocks but for the Stabroek block, the then Government gave away 10 times that amount for a single license. We need to enforce our laws.

- Because of a lack of ring fencing, which ensures oil well expenses don’t spill over to other wells, we may never see the expenses for Liza 1 fall below 75%. The reason why is that Liza 1, Liza 2 and Payara have infrastructure expenses totaling US$18.5 billion. Seventy five percent of US$22.5 billion is approximately US$16.9 billion, which is less than the US$18.5 billion expenses. Thus, Liza 1 won’t be able to payoff the debt that has accumulated, as part of capital costs, for the Stabroek block. Thus, the maximum we could get from Liza 1 is about 14.5%. In dollar terms that is US$3.3 billion. The average worldwide government take is 69% from an IMF analysis of 67 oil regimes. We cannot be off the chart with a 14.5% take from Liza 1.

- The Stability Clause in the contract that prevents Guyana from renegotiating a fair deal is unconstitutional. Clause 32 of the contract is is ultra vires, unconstitutional, undemocratic, and is contrary to Article 65(1) of the Constitution of Guyana by purporting to bind subsequent Parliaments under Clause 32.4 of the 2016 agreement. We cannot be violating our own constitution.

- Suriname has discovered about 100 million barrels recently whereas our projected find stands at 13 billion barrels. Our oil reserves are 130 times that of Suriname. However, from the banner below we are a significantly worse deal than Suriname. We can have a fair deal if we renegotiate for a 10% royalty and 25% tax rate. That will bring in an extra US$109 billion US as mentioned above.

- Demand better local content policy and it should be enshrined in law.

- Establish a petroleum commission with broad representation from all sectors of society including qualified experienced experts from the diaspora with adequate resources to execute its investigative, oversight, and enforcement functions.

References:

- https://www.washingtonpost.com/business/economy/bps-big-bill-for-the-worlds-largest-oil-spill-now-reaches-616-billion/2016/07/14/7248cdaa-49f0-11e6-acbc-4d4870a079da_story.html

- https://www.kaieteurnewsonline.com/2021/02/22/2019-repsol-mud-spill-could-have-been-as-catastrophic-as-bp-well-blow-out-dr-adams/

- https://www.stabroeknews.com/2021/01/11/news/guyana/global-witness-withdraws-report-on-exxon-deal/