Exxon will obtain 63.75% of the Profit Share after tax payments are made by the Guyana Government, when applying Guyana’s current tax rate of 27.5% for Non-commercial Companies. Exxon is used in this article to represent Esso Exploration & Production Guyana Limited, CNOOC Nexen Petroleum Guyana Limited and Hess Guyana Exploration Limited.

Clearly from sections in Article 15 of the Petroleum Sharing Agreement (PSA), the Government of Guyana (GoG) is obligated under the 2016 Petroleum Sharing Agreement to pay Exxon’s share of Corporate Taxes.

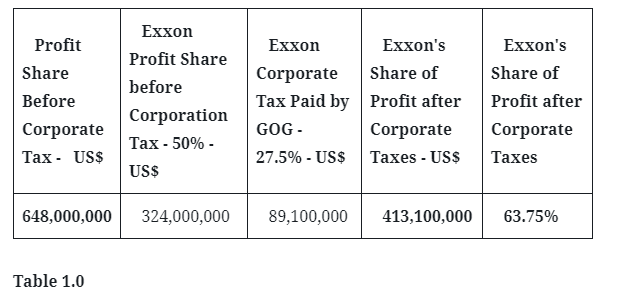

The table below uses a hypothetical annual profit before taxes of US$648,000,000 and the current tax rate imposed by Guyana Revenue Authority on non-commercial companies in Guyana.

Article 15.4 (a) That a sum equivalent to the tax assessed pursuant to Article 15.2 and 15.3 will be paid by the Minister to the Commissioner General, Guyana Revenue Authority on behalf of the Contractor and that the amount of such sum will be considered income of the Contractor.

Article sections 15.2 and 15.3 referenced in Table 1.0 are detailed below and validates the profit share after corporate tax adjustments from the PSA results in 36.25% for GoG and 63.75% for Exxon.

15.2: Except as provided in this Article 15, Contractor, Affiliated Companies, Sub-Contractors and individuals who are expatriates shall be subject to the income tax laws of Guyana, including, the Income Tax Act of Guyana (Cap. 81:01) and the Corporation Tax Act of Guyana (Cap.81 :03) and shall separately comply with the requirements of those laws, in particular with respect to filing returns, assessment of tax, and keeping and showing of books and records

15.3: The taxable income of the Contractor arising in each year of assessment under this Agreement for purposes of the income tax laws of Guyana, (including the Income Tax Act and the Corporation Tax Act referred to in Article 15.2) shall include the amounts of Contractor’s income tax and corporate tax and corporation tax paid Pursuant to Article 15.4.

The impact of the paying of Exxon’s corporate tax “paid by the Minister to the Commissioner General, Guyana Revenue Authority on behalf of the Contractor and that the amount of such sum will be considered income of the Contractor” takes Exxon’s share to 15.9375% ((12.5)+0.275*12.5); while Guyana obtains 9.0625% ((12.5)-0.275*12.5).

A wise quote from American industrialist and business magnate Henry Ford — ‘Whether you think you can, or you think you can’t – you‘re right.’; aptly sums up that Guyana verily needs leadership with a can-do attitude.

Nigel Hinds