A prudent homeowner, who wanted to sell his house, would gauge what is a fair asking price by surveying the sale price for other houses in his neighbourhood. It would spin in his mind for years, if after the sale, he discovered that he had sold his house for a large discount to what a buyer with integrity was willing to pay. Several years ago, the IMF did a study of 67 petroleum agreements where it showed the “government take” normally fell between 65% and 85%. For the Stabroek block, Guyana’s share of oil revenues will be a nightmarish low of 14.5% for many years to come. A haunting figure.

The Stabroek Oil block has so far turned up 18 oil discoveries. Thus far, 3 of those discoveries have been turned into projects. They are the Liza Phase 1 with a capital cost estimated at US$3.5 billion. The Liza Phase 2 with projected capital cost of US$6 billion. And, the recently approved Payara at US$9 billion. That is a total of US$18.5 billion in capital costs.

But because of lack of ring fencing which means Exxon can allocate any losses from one project into another, the 75% maximum expense of revenue will be lingering for many years. With ring fencing, each well is treated as a separate project, and losses cannot be carried over to another project causing Guyana to lose income. Thus, given the no ring fencing between the Liza Phase 1, Liza Phase 2 and Payara projects, the recent US$9 billion capital cost for Payara would mean Guyana will probably earn a paltry 14.5% for a number of years.

Liza Phase 1 became operational in December 2019. It has struggled to reach its goal of 120,000 barrels per day but it is approaching that figure. Liza 2 is slated to start production of 220,000 barrels a day in 2022 and Payara the same output in 2024.

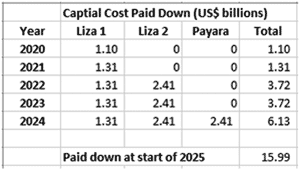

Let’s assume Liza-1’s average for this year is 100,000 barrels per day and the average price of Crude Oil is US$40/barrel for the year. And in the most optimistic scenario, 75% of revenue is used to pay down the capital cost. There will be operating costs which would reduce how much of the 75% is used to pay down capital costs but let’s ignore that for simplicity. In this optimistic scenario we would have paid down US$1.1 billion by December 2020 out of the US$18.5 billion we owe just for the first 3 projects.

If oil price hovers around US$40/barrel for the next five years, then the table shows how much we would have paid down at the start of 2025. A copy of the table is available, at http://www.oggn.website/wp-content/uploads/2019/10/stabroek_capital_costs_paid.xlsx

From the table, we would have paid down US$16 billion at the start of 2025. That would leave us about US$2.5 billion to payoff in 2025. Thus, at some point in 2025, we should see the 14.5% of revenue share start to approach the bottom of the IMF average government take, right? No, it is likely other projects within the Stabroek Block would have been approved before 2025 with billions in capital costs. Plus, it was assumed that 75% of revenue was used to pay down capital costs but a more realistic figure would have been a smaller percentage. Thus, we will have the 14.5% ring around our necks for many years to come. It will haunt us for generations.

Yours truly,

Darshanand Khusial