According to the last count, there are seven countries that have jettisoned their national currency and adopted the American dollar as their legal tender. There are also four countries that have adopted the euro as their currency. These are examples of complete dollarization or euroization. Closer to home, Panama and El Salvador of Central America, are two examples of complete dollarization. Two examples of complete euroization are Kosovo and Montenegro.

There are, however, examples of partial dollarization where a national currency exists side by side with the dollar. In a regime of partial dollarization, the dollar encroaches on some functions of the national currency’s roles. We do not need to go far as there are several instances of partial dollarization and encroachment in the Caribbean. For example, Jamaica allows its nationals to save and borrow US dollars from the local commercial banks, merchant banks and building societies. As at April of 2023, the total US dollar loans in Jamaica amounted to $1.58 billion while the total amount saved is $4.47 billion. These numbers indicate that many Jamaicans save in US dollars in order to hedge against persistent structural depreciation of the J$. Moreover, when Jamaicans save at home in American dollar bank accounts that currency is replacing a slice of the store-of-value function of the Jamaican dollar

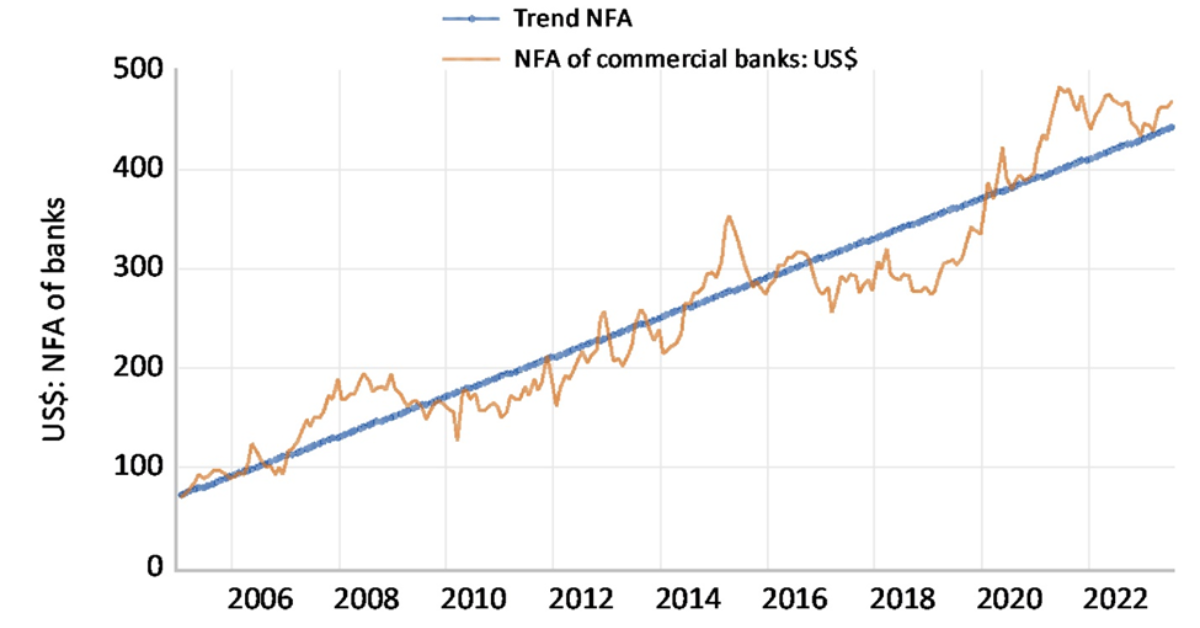

I will not get too deeply into forming an opinion regarding the consequence of this dollar deposit-loan arrangement – which has its genesis in the high Jamaican inflation of the 1990s – except to say that it appears to complicate the Bank of Jamaica’s ability to conduct monetary policy, especially using the interest rate instrument as part of its inflation targeting framework.

There are yet other examples of partial dollarization in the Caribbean. For example, when someone travels to Barbados a taxi driver or a retail outlet will willingly accept the US dollar, but will return change in the Barbadian dollar. A similar experience occurs in The Bahamas. Interestingly, I was able to obtain change in US dollars at the Norman Manley International Airport in March of this year, implying that there is probably a greater degree of dollarization in Jamaica compared with Barbados. The last I passed through the Grantley Adams International Airport, I could not get my change back in US dollar. As far as I am aware, Barbados does not allow US dollar saving and loan accounts as in Jamaica, thus restricting the dollar’s encroachment in the context of store of value. However, it would appear like the dollar has eroded some medium of exchange functions of various Caribbean currencies.

For the most part, Guyana is not as dollarized compared with the examples I have given above, a feature that predated the oil boom. There is no large foreign currency saving and loan accounts in Guyana. However, recent changes in the retail industry are encouraging greater acceptability of the US dollar as a medium of exchange. When paying in dollars, the change is often made in the Guyanese currency. I would anticipate that the newly rich business class of Guyana will push for loan and deposit dollarization in the near future given their relative embeddedness in the ruling political party.

Although not necessarily a sign of creeping dollarization, newcomers to Guyana, a few regional banks, and some collaborating local money changers have been sucking foreign currencies out of Guyana and taking them overseas as the oil boom creates ample inflows here compared with the shortages in the Caribbean, namely Trinidad and Tobago. The latter, however, is not the main reason why there are reports of temporary shortages of US dollars in the local market. We will have to explore this matter in greater detail in the future.

Typically, a nation ditches its national currency when there has been a period of great financial turmoil and hyperinflation, none of which is a feature of contemporary Guyana, although there are good reasons to believe that the inflation rate is higher than what the government reports. However, such a higher inflation rate is still not consistent with historical examples when countries ditched their national currency.

Often Panama is given as an example of a successful dollarized case. However, the others who have replaced their currencies are hardly success stories. Panama’s success has nothing to do with dollarization, but mostly to do with winning the geography lottery by having a slim piece of land that allowed for building a canal that links two oceans. The canal has been bringing in a stable source of income to Panama for decades, as well as serving as a catalyst for an outsized and successful service-based economy.

One argument for dollarization is it constrains the government. Essentially, the government cannot spend what it does not have in tax revenues. For example, it will not be that easy to raise funds for government spending by increasing the debt ceiling, as the Minister of Finance did recently. The overdraft on the Consolidated Fund will not be possible. That means civil servants could go without pay if the US dollar is not available. Of course, several thousand public workers could be sent home to balance the budget as US dollars cannot be printed by the BoG, as was done during the period of overdraft.

Indeed, my conservative friends will say tying the hands of the government is a good thing. But one has to be prepared for higher unemployment and greater instability given that the public service is a major battle ground for patronage in Guyana via contract employment. I would anticipate an increase of crimes as the government is forced to restrict its spending. Usually social spending is the first to go. Suffice to say, dollarization can depress prices and rein in inflation, making it a desirable state for wealthy financial asset holders.

One has to also consider the initial condition or the starting point. Ditching the Guyana dollar and adopting the US dollar cannot be done without consideration of who owns the assets of Guyana, especially financial assets. Another way of thinking about dollarization is to equate it with a one-to-one Guyana dollar relative to the dollar. This will have major distributional effects, which I still have to ponder more deeply. In general, dollarization is usually preferred by asset holders. Debt holders (think about all those housing mortgages) are not going to like it.

Dollarization fundamentally changes the role of the central bank. It will still have a regulatory role and one related to maintaining financial stability. I would argue that the BoG will still have to hold a stock of foreign exchange reserves to facilitate foreign exchange transactions because of the high capital flight and leakages of foreign currencies from Guyana. There will have to be a buffer stock of dollars and the BoG will be the place to do this. Instead of active exchange rate management, the central bank assumes a buffer-stock role – in addition to its role of overseeing the Natural Resource Fund – by releasing foreign exchange to people who cannot obtain them from the private sector.

Our friend, Dr. DeLisle Worrell, argued convincingly in his recent Routledge book that countries do not need to hold a lot of foreign reserves. It is a misuse of investment funds, according to the former Governor of the Central Bank of Barbados. However, DeLisle is coming from a Barbadian perspective where there is a high degree of social consensus in favour of a pegged exchange rate. As a matter of fact, there is a literature on this topic of the social consensus among Bajans relating to the exchange rate system.

I am not so sure, however, that the BoG will be able to just hold a small buffer stock of US dollars, especially since there appears to be control of important arms of government (and quasi-government) by special business interests. Embedded autonomy has long left the Guyanese civil service since the days of party paramountcy. These days business interests have captured important arms of the bureaucracy and some are deeply embedded in the PPP.

Comments: tkhemraj@ncf.edu