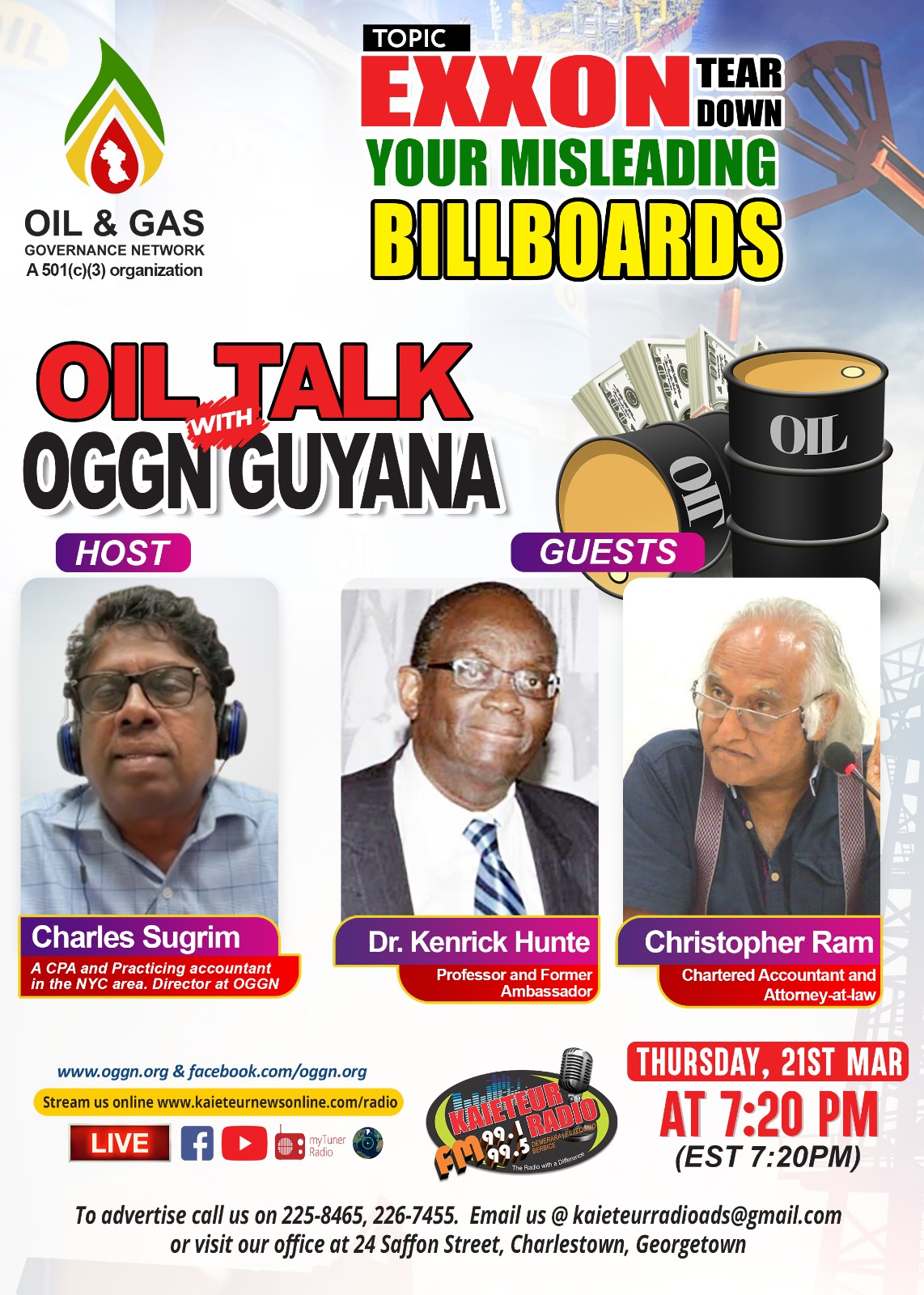

1. Q: What kind of audit was conducted on ExxonMobil’s costs?

A: It was a ministerial audit required by Guyana’s 2016 petroleum agreement.

2. Q: What costs were audited?

A: ExxonMobil’s pre-production costs from 1999 to 2015.

3. Q: How much in costs did the audit find were ineligible for cost recovery?

A: $214 million.

4. Q: How much additional revenue would Guyana gain if the $214 million is confirmed disallowed?

A: $107 million.

5. Q: What concerns were raised about the audit process?

A: Records were missing, Exxon had chances to provide more documentation, and the audit report took years to release.

6. Q: How frequently does the agreement require audits to be conducted?

A: Annually, within two years.

7. Q: When was this audit conducted relative to that requirement?

A: Years late.

8. Q: What does the lateness of the audit do?

A: It reduces the audit’s reliability.

9. Q: Does Guyana have the expertise to thoroughly review complex oil agreements and audits?

A: Potentially not.

10. Q: What could happen if Guyana lacks expertise to review audits?

A: It risks not identifying improper cost recovery claims.

11. Q: How did Exxon respond to the initial audit findings?

A: It was able to improperly reduce the questioned costs after the audit.

12. Q: What does the agreement say about the audit process requirements?

A: Details the contractual requirements and process.

13. Q: How well was the audit process managed?

A: The audit process and review was mismanaged.

14. Q: What indicates problems with Guyana’s management of the audit?

A: The lateness, process issues, and potential lost revenue.

15. Q: What is the overall concern raised by the interview? A: That the Exxon audit debacle shows issues with Guyana’s oversight of oil agreements.