Reference is made to your article captioned ‘Exxon must now put decommissioning fund in place for all Guyana projects – Minister Bharrat’ (KN 11-16-2023).

In that article, it is reported that ‘…the company (EMGL) would have to submit for the minister’s approval, a proposed decommissioning plan and budget no later than two years before the expiration of a petroleum licence or no later than two years before the anticipated end of production.’.

Editor, this approach by the Government on this matter is ill-conceived, for to wait until ‘two years before the expiration of a petroleum licence or no later than two years before the anticipated end of production’ can only be identified as another bill to be paid by Guyana from its already meager share of 14.5 barrels out of every 100 barrels of oil.

It is therefore contended that the budget for the decommissioning of the oil project, and the restoration of the environment, must be components in the cost structure of every barrel of oil that is extracted from the oil reservoir. Notably, the cost structure should include a budget for exploration, development, infrastructural maintenance, operating costs, insurance for an oil spill, the loss of income for the fishing sector, and the cost associated with the decommissioning of the project, and the restoration of the environment.

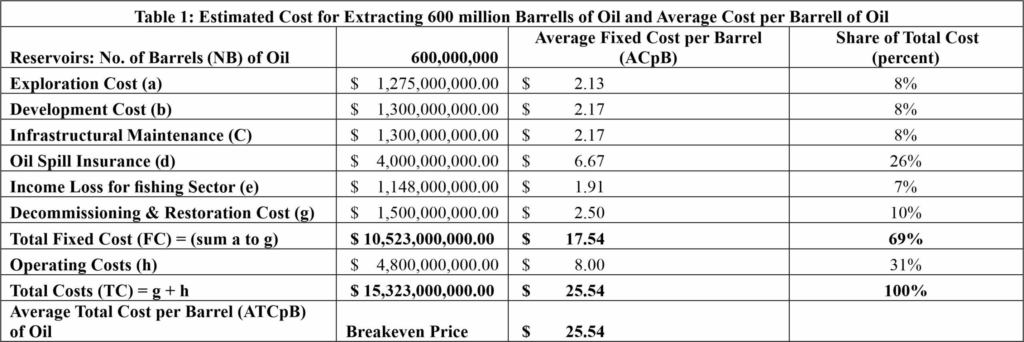

For example, if an oil reservoir has 600 million barrels of extractable oil, and the estimated total cost of extracting the oil is US $15.323 billion, then it can be derived that the average total cost of a barrel of oil is US$25.54 (that is, US$15.323 billion divided by 600 million).

Table 1 below contains an identification of the cost categories of a barrel of oil extracted from a hypothetical oil reservoir. It should be noted that decommissioning and restoration costs (US$1.5 Billion) are estimated at US$ 2.50 per barrel of oil, accounting for 10 percent of the average total cost of a barrel of oil at US$25.54 per barrel. Consequently, allocating US$2.50 per barrel of cost oil and placing these funds in an interest-bearing bank account will guarantee that funds will be available to complete the decommissioning and restoration projects, estimated to be on or before some twenty years into the future when the reservoir is commercially exhausted.

Interestingly, since Liza 1 and Liza 2 have been in operation for the last 4 years (2019 to 2023), the Government of Guyana must be able to show the Guyanese people how much money has been deposited in the Decommissioning and Restoration Fund (DRF). Undoubtedly, this will be the action of a caring Government; and the implication which can be drawn from this considered action is that future generations will not have the anxiety of finding money to clean and restore the environment. In other words, our current policy makers would have done a good job of passing on funds, instead of an unfunded liability to future generations. Therefore, it is incumbent upon current policy makers to publish the financial data showing the amount of money that has been set aside for the DRF.

Finally, it can be observed that in none of the cost categories identified in Table 1 is there any mention of the price of a barrel of oil. The reason for highlighting this concern is because the cost recovery equation that EMGL employs in the PSA is specified as: Cost recovery is equal to 75 percent of Total Revenue, where Total Revenue is the price of a barrel of oil times the number of barrels of oil. This arrangement is therefore a fictitious financial story of “a fake cost recovery equation that enables a Profit Squeeze that Guyana endures under the existing PSA”. This conundrum will be explained in another letter.

Sincerely,

Dr. C. Kenrick Hunte

Professor and Former Ambassador