A distinguishing feature of the Production Sharing Agreement (PSA) between ExxonMobil Guyana Limited (EMGL) and the Government of Guyana (GOG) is the contrived way in which total cost is specified in the business.

In particular, the total cost (TC) is specified as: TC = 0.75TR = 0.75PQ, where TR is total revenue, P is the selling price of a barrel of oil, and Q is the number of barrels of oil that are sold. By including the selling price of a barrel of oil in the Total Cost equation; and recognizing that the 0.75 factor is an arbitrary factor imposed by EMGL (see Article 11 in the PSA), these two indicators generate a baked-in profit squeeze mechanism that increases (decreases) the cost of a barrel of oil whenever the price of a barrel of oil increases (decreases). For example, since the Total Cost is equal to: TC = 0.75 PQ; therefore, the average cost of a barrel of oil (ACBO) is: ACBO = TC/Q= (0.75PQ)/Q = 0.75P. Furthermore, acknowledging that the price of a barrel of oil is known, it therefore follows that the ACBO is known, even without examining the quantity and prices of the inputs used in the extraction operation; or even without scrutinizing the paperwork of the wages paid to workers.

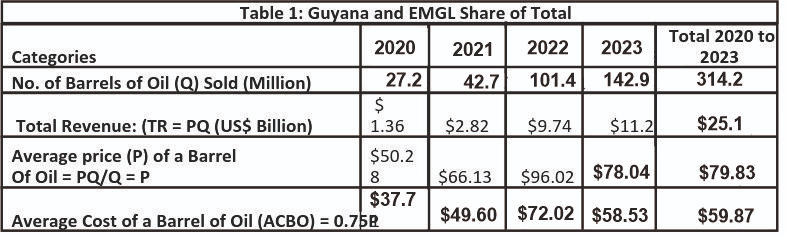

Published data by the Bank of Guyana and Oil Now confirmed that during the period 2020 to September 2023, a total of 273.8 million barrels of oil (Q) were sold

(https://bankofguyana.org.gy/bog/images/research/Reports/ANNREP2022.pdf; https://bankofguyana.org.gy/bog/publications/natural-resource-fund/quarterly-reports; https://bankofguyana.org.gy/bog/images/research/Reports/September23.pdf; https://oilnow.gy/featured/2023-saw-guyanas-total-oil-ouput-at-142-9-million-barrels-finance-minister/).

Also, given that the Bank of Guyana published the total profit and royalty that Guyana received; and recognizing that Guyana received 14.5 percent of total revenue, it can be derived that the total revenue for the period 2020 to 2023 amounted to US$25.1 Billion, with the average selling price of a barrel of oil equal to US$79.83, along with a low price of US$50.28 in 2020 and a high price of US$96.02 in 2022 (Table 1).

From the information presented in Table 1, it is obvious that whenever the price of a barrel of oil increases (decreases), the ACBO increases (decreases). For example, when the price of a barrel of oil is US$50.28, US$66.13, US$96.02, US$78.04, or US$79.83, the corresponding average cost of a barrel of oil is $37.71, US$49.60, US$72.02, US$58.53 or US$59.87. This outcome of the fluctuating ACBO when the selling price of a barrel of oil changes is the baked-in profit squeeze mechanism of total cost being 75 percent of total revenue: ACBO = 0.75P; and in this regard, whenever the price of a barrel of oil increases (decreases), the average cost of a barrel of oil increases (decreases). This is wrong, and it must be terminated.

It is also important to point out that oil price data will show that the selling price of a barrel of oil is highly volatile (See the Oil chart at: https://oilprice.com/oil-price-charts/), due to factors related to world demand and supply conditions; oil supply decisions by the Organization of Petroleum Exporting Countries (OPEC); political unrest; environmental concerns or wars, such as the case of Russia and Ukraine; and the Houthi attacks in the Red Sea that increase shipping costs.

Therefore, including the selling price of oil in the cost equation is a programmed profit transfer mechanism to EMGL that facilitates the urgency for looking at unauthorized opportunities to spend revenue up to the ever-changing absolute value of the total cost amount. And what reinforces the incentive to spend up to the 75 percent of total revenue are the limited auditing arrangements that curtails access to all the extraction and financial data; the unfortunate requirement of going to arbitration in the USA to resolve cost challenges, knowing that Guyana will have to pay the expenses for the lawyers hired by EMGL to defend EMGL positions; and the open gateway to engage in

unauthorized spending in unapproved projects, given the absence of ring-fencing. Incidentally, when a project is ring-fenced, the breakeven quantity is established and the correct estimate of profits can be determined. Not surprisingly, the breakeven quantity under the existing PSA will be much larger; and this will significantly reduce profits and the profit share that Guyana receives.

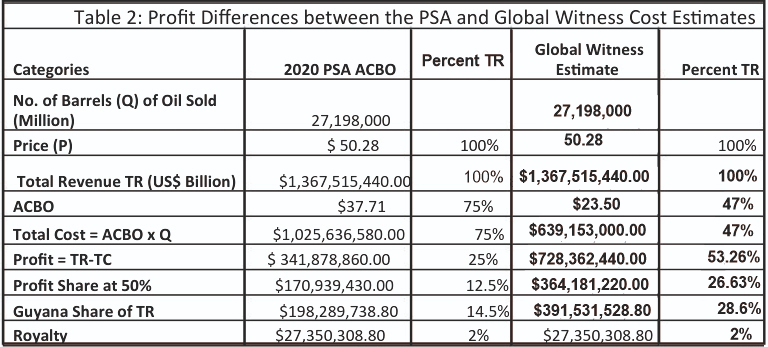

In a 2020 study on oil in Guyana prepared by Global Witness (https://nextcloud.a193.ca/s/saLx2sDiDBbm4Lb), it was reported that the average cost of a barrel of oil was US$23.50, consisting of exploration cost (US$0.94), development cost (US$11.58), and operating cost (US$10.98). Obviously, when this low cost per barrel of oil is compared with ACBO = 0.75P, profits will be much larger than previously discussed. Table 2 contains the comparative financial data and the profit levels, using the average cost of a barrel of oil in 2020. While noting that the total revenue (US$1.4 Billion) and royalties (US$27.4 Million) under the two methods (PSA compared with Global Witness) are the same, the profits and the shares of total revenue are different, due to the lower total cost in the Global Witness approach, which has a much lower average cost of a barrel of oil.

In particular, Guyana’s share of total revenue is no longer 14.5 percent (US$198.3 Million), but it would be 28.6 percent (US$391.5 Million), an increase of US$193.2 Million. Undoubtedly, this is a measure of the hidden profits from Guyana for just one year. Imagine what it would be for 20 years with more Floating Production, Storage and Offloading (FPSO) ships coming on stream? I therefore contend that equity and fairness must be the basis for using all of our non-renewable resources (oil, gold, diamonds, bauxite, manganese, sand, clays, other). In fact, the expectation that in the future, Guyanese will receive a higher share of revenue is a false hope; for the currently used oil reservoirs will in the future only have unprofitable quantities of oil remaining, and these reservoirs will be decommissioned. And only new reservoirs will keep the oil flowing, but the PSA shares will remain the same: 14.5 barrels out of every one hundred barrels of oil for Guyana. Editor, I conclude by stating: please policymakers, standup for Guyana, do your job, and protect our patrimony for our current and future generations.

Sincerely,

Dr. C. Kenrick Hunte

Professor and Former Ambassador

Article Originally Published At: https://www.kaieteurnewsonline.com/2024/01/22/exxonmobil-guyana-limited-profit-squeeze/