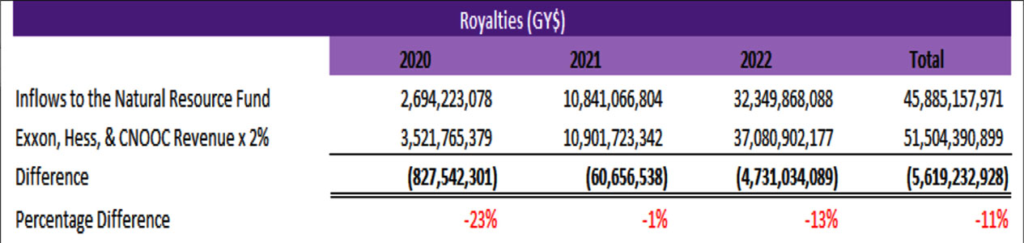

Analysts attempted to reconcile the 2020-2022 Guyana Natural Resource Fund royalties’ balance. To their dismay, there is a significant shortage of royalty payments in the years 2020 and 2022, 23% and 13% respectively. The Natural Resource Fund appears to be missing an approximate GY$5.6B (US$27M) in royalties, payments that Exxon and its affiliates should have made.

Comparisons were made between Bank of Guyana publications on the Natural Resource Fund and Exxon, Hess, and CNOOC’s audited financial statements. Inflows for royalties should match 2% of petroleum sales reported by the oil companies. Immaterial differences should be the result of timing; as seen by the 1% variance in 2021 (Exhibit 1). However, there are material differences in the years 2020 and 2022 that require immediate attention. The Government of Guyana needs to verify the financial information provided by Exxon. If the government does not reconcile the Natural Resource Fund, there is an assumption that Exxon, Hess, and CNOOC have breached the PSA (Production Sharing Agreement).

Exhibit 1 reflects inflows to the Natural Resource Fund converted to GY$, per the fund publications. There is no explanation as to why the exchange rate remained constant across all the years at $208.50. Analysts sourced revenue from the audited financial statements of Exxon, Hess, and CNOOC, multiplied by the 2% royalty rate. Surprisingly, EEPGL (Esso Exploration & Production Guyana Limited) was the only company to footnote revenue of its tax expense in 2022. The company took a GY$59B tax expense and included this expense as non-customer revenue. This inclusion of tax expense in revenue is a requirement by the PSA but does not abide by Guyana income tax laws or financial accounting rules. Exxon, Hess, and CNOOC all report Guyana income tax expenses in their financial statements, but do not pay this tax to the GoG (Government of Guyana). However, these same organizations received approximately US$1.4B in tax-paid receipts from the GoG. To further complicate matters, EEPGL was the only company that reported royalty expenses in its income statement, which is severely understated considering that the required royalty payment should be 2% of revenue.

The integrity of the oil companies’ financial statements is questionable. The audited financial statements for the years 2020-2022 limit the data that the public can analyze and therefore assumptions must be made: did Exxon short the Guyana Natural Resource Fund by US$27M?

Exhibit 1

Exxon, Hess, and CNOOC’s business operations in Guyana, derive revenue from the sale of crude oil. Financial professionals analyze production data for the accuracy of revenue. Exxon’s failure to disclose production data during the Guyana 2018-2020 US$7.3B cost recovery audit, an audit report that the government failed to release, reemphasizes the continuous risks of the inability to trust or verify Exxon’s information. This risk exposure is amplified when reconciling Guyana’s profit oil. The 2020-2022 Natural Resource Fund inflows relating to profit oil amounted to GY$342B. Guyana’s profit oil balance is seven times the royalty balance and is dependent on mechanisms of cost recovery, which are recoverable costs that remain undisclosed to the people of Guyana. If the cost recovery statements contain inaccuracies, such as those reported in the 2020 to 2022 revenue and royalty expense accounts, the potential for profit oil shortages in the Natural Resource Fund will be exponential and a US$27M royalty shortage will pale in comparison.

Considering the GoG and the petroleum bloc of Exxon, Hess, and CNOOC, are contractually binding business partners, clarity to this opaque financial predicament can easily be resolved when the GoG reconciles the balances in the Natural Resource Fund. After all, the money belongs to the people of Guyana.

By Candice Dorwish

Article Originally Published At: https://www.stabroeknews.com/2024/02/25/opinion/letters/natural-resource-fund-appears-to-be-missing-us27m/