ExxonMobil Guyana Limited profit squeeze

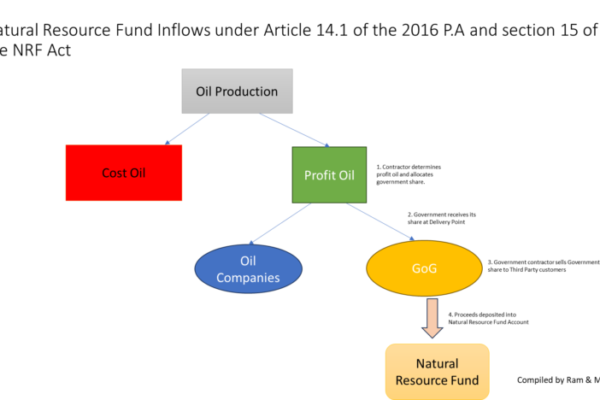

A distinguishing feature of the Production Sharing Agreement (PSA) between ExxonMobil Guyana Limited (EMGL) and the Government of Guyana (GOG) is the contrived way in which total cost is specified in the business. In particular, the total cost (TC) is specified as: TC = 0.75TR = 0.75PQ, where TR is total revenue, P is the…