In the previous column we explored the possibility of Guyana becoming a petro state overnight. A petro state is one in which most government revenue comes from oil royalties and profit share. The government is then tasked with spending and distributing these funds among competing interests. The last column was sceptical about the Guyanese state’s ability to effectively, optimally and fairly spend the new revenues.

By 2021 Guyana would likely earn around US$320 million per year, assuming production of around 100 thousand barrels per day and an oil price at US$50 per barrel. If the contract is renegotiated and royalties jump to 8%, the annual revenue becomes US$420 assuming no change in production rate and US$50 per barrel.

The US$320 million annual revenue will represent a little more than 10% of GDP and the US$420 million will be around 14% of GDP. Presently all the taxes Guyana collects amount to approximately 28% of GDP. However, taxes are in local currencies and the oil revenues are in foreign exchange, which we know is crucial for the smooth functioning of small economies like ours.

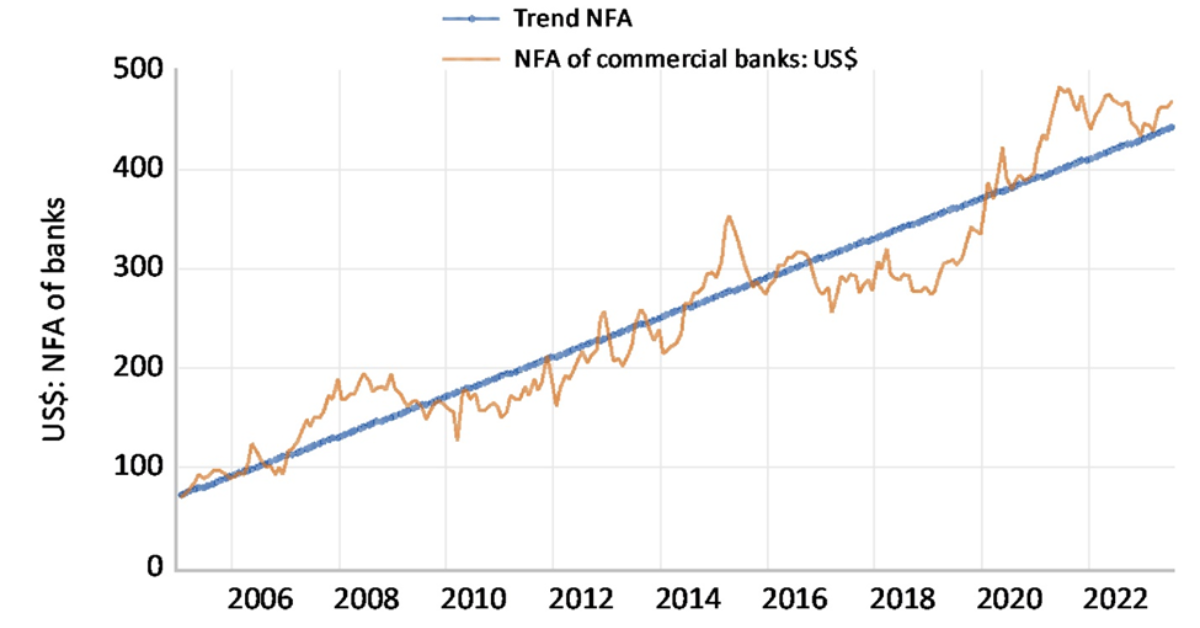

These projected amounts, based on calculations from the Oil and Gas Governance Network (http://www.oggn.website), are not a lot of money given the needs of Guyana. The expected revenues will have to replace the foreign exchange loss from sugar, bauxite and rice since 2012. For example, the foreign exchange earned by bauxite, sugar and rice in 2012 amounted to respectively US$151 million, US$132 million and US$196 million. By the end of 2016 these exports were respectively US$92 million, US$73 million and US$179 million. We are still awaiting the data for the entire 2017, but the trend is clear. I emphasize the starting point of 2012 because that year represents a turning point in Guyana’s economic activity. The present downturn in the economy has its genesis around 2012. If these three sectors continue their decline until 2021, the new oil revenues will be making up for the loss in foreign exchange that once came from the declining sectors.

The unpleasant outcome in the presence of ample foreign exchange is a phenomenon known as the Dutch disease, which can manifest itself in various forms. The phenomenon got its name from the observed decline of manufacturing in the Netherlands some years after the success of the gas sector in that country. The general feature of the Dutch disease, then, is a decline in production and export in other export-based (tradable) sectors as oil and gas revenues boom.

The first channel of the Dutch disease is an appreciation or strengthening of the exchange rate and increase in domestic prices. This makes the other exports less competitive in the international arena, thus causing the decline in the non-petroleum sectors. As noted above, there is already a decline in other traditional exports since 2012. The negative effect could be felt in the emerging tourism and other service-based sectors and the burgeoning rum exports, assuming the foreign buyer is quoted in local currency.

A slight appreciation of the Guyana dollar, however, could be helpful in reducing the cost of living for the poor by deflating import prices. Nevertheless, the successful export-based companies such as DDL and Banks DIH, as well as local gold exporters, will realize fewer Guyana dollar profits in the event of appreciation. Therefore, the strengthening of the Guyana dollar below the psychologically appealing threshold of G$200 to US$1 could have serious dislocations such as job losses in the private sector. At present the exchange rate is averaging around G$210 to US$1.

The Dutch disease could also occur through the overly ambitious expansion of public sector employment. History tells us this is a real possibility in Guyana after 2021. Given the political structure of Guyana, winning an election often involves rewarding base supporters with civil service jobs. This problem becomes more acute if the expansion in employment is skewed in favour of quantity than quality. The public service is a classic non-tradable sector – one which does not generate foreign exchange through exports – and a booming wage bill and increasing wage rate there will make it hard for the non-oil export sectors to succeed.

The booming public service wage bill will increase demand for assets such as land, housing and cars. If there is no proper planning by central government, one can witness a worsening of the housing problem for the poor and traffic congestion for the middle class. This becomes even more likely under an APNU+AFC government which has been timid towards an aggressive housing programme, perhaps because of the ancestral land claims from some members of its base. The government might want to solve this land rights problem before a large-scale housing programme. It might be too late.

These probable scenarios signal the necessity for effective management of the macro economy through fiscal and monetary policies, while a growth strategy is supported through smart strategic industrial policy promoting cooperation between the empowered government – the overnight petro state – and private sector. Managing the national currency in line with the psychologically appealing G$200 to US$1 would also require very smart monetary policy. Moreover, the monetary authority will not only need to watch closely the consumer price level, but also put in place systems to manage asset prices (such as real estate prices) fuelled by credit booms.

Fiscal policy becomes even more important through a stabilization fund since oil revenues will come with wide swings, while government’s commitments are smooth and certain. This means Guyanese should start thinking not only about a Sovereign Wealth Fund (which I don’t think is necessary for the first five to ten years), but also a fiscal stabilization fund. The latter is needed from the very beginning.

Management, therefore, becomes even more important for the government and quasi-government organizations in the face of Dutch disease scenarios, such as those identified above and other forms that will arise. The quality of the institutions will matter much more than the quantity.

We will continue these discussions in the next column.